Agricultural producer prices expected to soften further

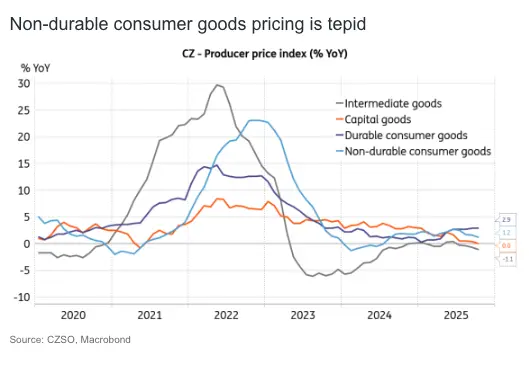

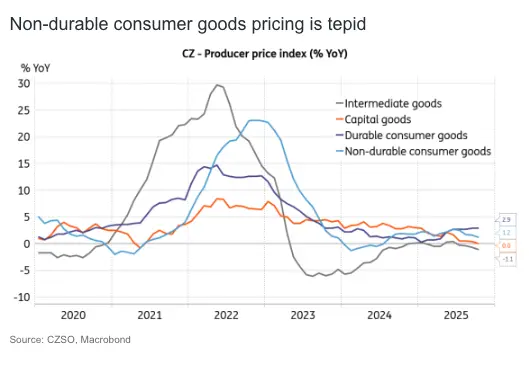

Industrial producer prices dropped by 1.2% year-on-year in October and shed 0.1% month-on-month, in line with market expectations. Agricultural producer prices added 3.2% YoY in October, rising by 3.0% MoM. Construction work prices were 3.2% higher YoY and gained 0.1% MoM. Annual dynamics in service prices for businesses slowed to 4.3% in October, while service prices increased by 0.3% from the previous month.

The noticeable deceleration in agricultural producer prices is an unusual development. Prices of crop production recorded a pronounced annual decline of 2.5% in October, despite a strong monthly gain of 8.6% (similar gains observed in the previous two years). Overall, crop yields have been strong this year, yet prices for certain products, such as potatoes, are plummeting across Europe.

Annual price growth of animal production decelerated for the first time since March, yet remained strong at 17.3% in October, supported by another monthly gain.

That said, lower feedstock prices resulting from good harvests, subdued global energy prices that will put a lid on fertiliser prices, and a strong koruna will likely somewhat dampen pricing in agriculture in the future.

Overall, muted industry pricing, slowing service price growth for businesses, weakening agricultural price trends, soft global energy costs, and a strong koruna pose downside risks to domestic consumer prices. However, if these pressures coincide with sustained robust household demand in the coming quarters, the impact on headline inflation should be limited. Our forecast expects inflation to remain close to target over the next year, averaging 2.1%.

If, however, the consumer pulls back – perhaps due to a higher unemployment rate – or if industry is unable to properly lift off, or there are unpleasant economic developments abroad, inflation could slip below the target over the next year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more (link to: https://think.ing.com/about/content-disclaimer/).